For SBVC Employees

Looking to Help Out?

Try Employee Payroll Contribution.

Employee payroll contribution is a convenient way for SBVC employees to support college programs, scholarships, and student success by automatically donating a chosen amount from each paycheck. It’s an easy, tax-deductible way to give back and make a lasting impact—one paycheck at a time.

Your gifts help provide scholarships, equipment that promotes student success, and program support.

Employees at SBVC may elect to support the work of the SBVC Foundation through payroll deduction.

These deductions may support specific programs or be undesignated to allow the Foundation to support areas of emerging needs.

By choosing to generously donate a small portion of your paycheck every month, YOU help make a difference in the lives of our students and community!

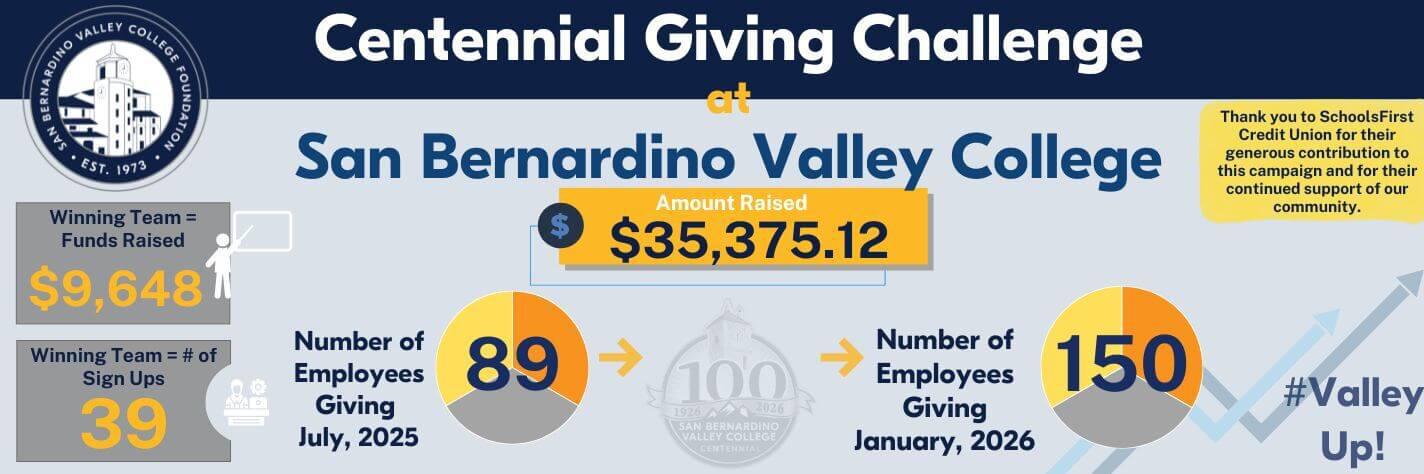

Employee Giving Centennial Challenge

The SBVC Centennial Giving Challenge is a friendly, campus-wide competition encouraging employees to give $10 per paycheck, or increase their current contributions, to support student scholarships.

-

CENTENNIAL SQUAD CAPTAINS:

-

Rangel Z

FACULTY

-

Carmen R

MANAGERS

-

Marie M

CLASSIFIED

-

Frequently Asked Questions

You can choose to contribute to any of the following:

-

Area of greatest need

-

Valley-Bound Commitment

-

Textbook scholarships

-

Foundation general scholarship fund

-

An established scholarship (you can specify the name)

-

A specific discipline or program of study

-

A specific fund of your choosing

- Online Form:

- Fill out the form and submit.

- PDF Form:

- Fill out the form completely, including:

-

Your name, last 4 digits of your SSN

-

Department/Division

-

Monthly deduction amount

-

Start date

-

Signature and date

-

-

Submit the signed form to the SBVC Foundation Office (Campus Center, CC-26). The Foundation will forward it to the SBCCD Payroll Office.

- Fill out the form completely, including: